Options Market Recovers From Monday’s Sell-Off: Bybit and Block Scholes Analysis

This post was originally published on this site

DUBAI, UAE, Jan. 31, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has released the latest crypto derivatives report, published weekly with Blocks Scholes.

This week’s report highlights a significant risk-off event early in the week, as DeepSeek’s LLM announcement coincided with sharp declines across major indices and crypto markets. Despite this volatility, open interest in perpetual swaps remained stable, with funding rates momentarily turning negative before recovering. The options market also saw increased trading activity during the sell-off, even as forward-looking volatility expectations declined.

Key Insights:

- BTC Open Interest Shows Minimal Movement – Despite the highest single-day trading volumes in BTC call options this month – reaching nearly $250 million during the spot price decline – volatility has continued to decline in both realized and implied terms. Short-tenor options are exhibiting lower volatility with a neutral skew, while longer-dated volatility smiles maintain a bullish bias towards out-of-the-money (OTM) calls, continuing a trend seen since the election.

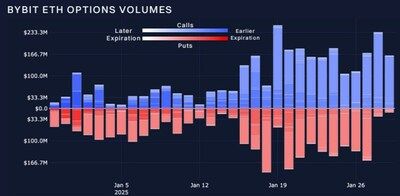

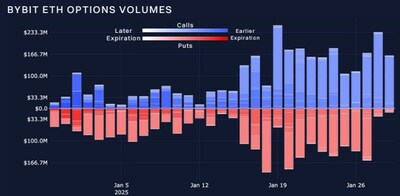

- ETH Options Maintain Bullish Momentum – Trading volume for ETH options has surged to its highest levels in a month, with open interest remaining heavily weighted toward calls. While the global market sell-off briefly impacted short-tenor ETH volatility smiles, ETH options have continued to trade at higher volatility levels relative to BTC. Despite ETH’s spot recovery lagging behind BTC’s, its options market remains strong.

- Solana Options See Solid Open Interest – Following a price rally spurred by the launch of two presidential meme coins, Solana (SOL) has retraced alongside the broader crypto market. However, open interest in puts and calls remains elevated, with trading activity surpassing pre-rally levels. Stable levels of newly opened put options suggest strategic protective buying to hedge profitable long positions in other instruments.

The Bybit x Block Scholes Crypto Derivatives Analytics Report continues to provide actionable insights for traders and investors, offering a detailed breakdown of market trends and trading dynamics.

Access the Full Report here.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://megastockalert.com/wp-content/uploads/2025/02/Sources_Bybit_Block_Scholes.jpg

Logo – https://megastockalert.com/wp-content/uploads/2024/03/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/options-market-recovers-from-mondays-sell-off-bybit-and-block-scholes-analysis-302365301.html

View original content:https://www.prnewswire.co.uk/news-releases/options-market-recovers-from-mondays-sell-off-bybit-and-block-scholes-analysis-302365301.html

Featured Image: depositphotos @ ilolab 3