U.S. Agencies Must Reveal Bitcoin and Crypto Holdings by April 5

This post was originally published on this site

The deadline for U.S. federal agencies to disclose their crypto holdings is rapidly approaching, with April 5 set as the date for agencies to report their Bitcoin and other digital asset holdings to the Secretary of the Treasury. This requirement is part of President Donald Trump’s executive order signed on March 6, which established a Strategic Bitcoin Reserve and a Digital Asset Stockpile. The order mandates that all federal agencies disclose the digital assets they hold as part of criminal or civil asset forfeiture proceedings.

Background on the Executive Order

The executive order represents a significant development in the U.S. government’s involvement with digital assets. It directs the Treasury Department to create two separate reserves — one for Bitcoin (BTC) and one for other cryptocurrencies such as XRP (Ripple), Solana (SOL), and Cardano (ADA). These assets will come from those seized during criminal investigations or forfeiture processes. According to David Sacks, the White House’s crypto czar, the U.S. government already holds approximately 200,000 Bitcoin, although a complete audit of these holdings has not been conducted to date.

U.S. Government’s Crypto Holdings: What We Know

As of April 1, 2025, the U.S. government is known to own 198,012 Bitcoin, valued at approximately $16.8 billion based on current market prices. This Bitcoin is part of the assets the government has acquired over the years through law enforcement actions. However, with the creation of the Strategic Bitcoin Reserve and the Digital Asset Stockpile, there is potential for these holdings to increase.

The Digital Asset Stockpile will not be limited to Bitcoin but will also include other major cryptocurrencies like XRP, Solana, and Cardano. President Trump has already indicated that these digital assets will be part of the reserve, potentially raising their profile and impact in the market. The federal agencies must report these holdings by April 5, providing a clearer picture of the U.S. government’s involvement with digital currencies.

What Will the Disclosure Mean for the Market?

Once federal agencies disclose their crypto holdings to the Treasury Secretary, it could have major implications for the cryptocurrency market. A more comprehensive view of the government’s digital asset reserves could lead to increased investor confidence, particularly in Bitcoin and the other cryptocurrencies listed in the executive order. If investors believe the U.S. government is increasingly backing these assets, it could provide a significant boost to their value.

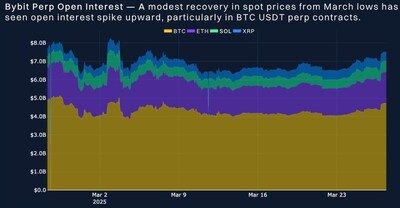

However, this move comes at a time when other economic concerns are weighing heavily on the markets. Although the cryptocurrency market rebounded slightly on April 1, the overall market cap has declined by approximately 7% in the past week, currently sitting at $2.76 trillion. Concerns over President Trump’s pursuit of a global tariff war and the impact of broader economic policies have dampened market sentiment, affecting both traditional and digital asset markets.

What’s Next for the U.S. Digital Asset Strategy?

Looking forward, the U.S. government will not be acquiring additional Bitcoin for the Digital Asset Stockpile beyond what has already been seized. However, there are still opportunities for agencies to acquire more assets through forfeiture processes. The Treasury and Commerce Secretaries have been authorized to pursue strategies to acquire more digital assets, though any additional Bitcoin acquisition will not affect the current stockpile’s composition.

This executive order could also lead to more comprehensive regulations for the crypto industry in the U.S. As the federal government becomes more involved with digital currencies, additional policies may emerge to govern their use, trading, and taxation. It’s clear that cryptocurrencies are becoming more intertwined with U.S. financial strategy, but how this will unfold remains to be seen.

Conclusion: A Turning Point for U.S. Crypto Holdings

The disclosure of U.S. crypto holdings by April 5 marks a crucial moment in the evolution of the nation’s relationship with digital assets. With Bitcoin, XRP, Solana, and Cardano poised to become part of the government’s stockpile, the spotlight is on these cryptocurrencies and how they will influence the broader market. As the world’s largest economy takes a more prominent role in crypto, the sector could see a shift in how governments and investors view digital assets.

Featured Image: Freepik © freepik