WXT Surged 101% in 24 hours, And the Price Exceeded $0.339.Why Can WXT Go to the Moon?

This post was originally published on this site

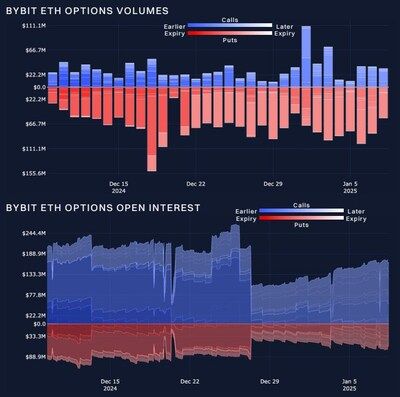

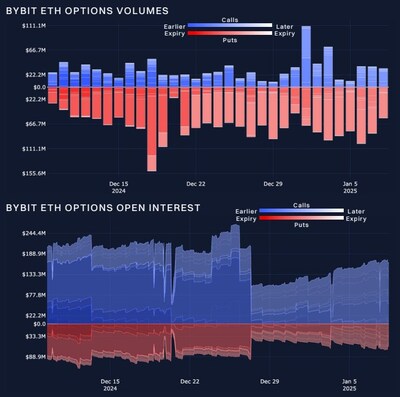

SINGAPORE, Jan. 13, 2025 /PRNewswire/ — Platform tokens have gained increased attention in this bull market, with notable examples from leading exchanges. Amid this surge, WXT, the native token of WEEX Exchange, has seen extraordinary growth, climbing 101% within 24 hours on January 11.

|

Token |

BGB |

OKB |

BNB |

MX |

WXT |

|

Opening Price |

$0.0585 |

$1.58 |

$0.15 |

$0.009157 |

$0.0100 |

|

Price One Year Ago |

$0.6002 |

$53.55 |

$302.07 |

$2.7978 |

N/A |

|

Current Price |

$6.73 |

$46.66 |

$681.33 |

$3.60 |

$0.0333 |

|

Year-To-Date Growth |

1021.29 % |

-12.87 % |

125.55 % |

22.28 % |

N/A |

|

All-Time High Price Change |

14412.82 % |

4572.78 % |

5288 % |

63785.55 % |

233 % |

|

Market Cap |

$8.08B |

$13.99B |

$98.11B |

$3.6B |

$83.19M |

This development coincides with WEEX’s ongoing global expansion. As a rapidly growing cryptocurrency exchange, WEEX continues to increase its presence in the competitive marketplace, with WXT emerging as an integral part of its ecosystem.

This surge comes as WEEX, continues to expand its global presence. WXT’s price trajectory reflects the growing influence of WEEX in the competitive cryptocurrency market.

WXT: Reflecting WEEX’s Rapid Growth

As Andrew Weiner, Vice President of WEEX, highlighted in a recent annual update, “WXT has achieved a price increase of nearly 450% since its issuance. And WXT’s trajectory mirrors WEEX’s incredible journey of growth.”

To further enhance its global outreach, WEEX has partnered with renowned football star Michael Owen as a brand ambassador. This collaboration aims to build increased brand visibility, positioning WEEX as a widespread and innovative platform in the cryptocurrency space.

According to the WEEX white paper, WXT’s ecosystem offers diverse utilities for its holders, including trading fee discounts, staking rewards, early access to new projects, and participation in airdrops. Additionally, WEEX has implemented a strategic buyback and burn mechanism, reducing WXT’s circulating supply as part of its ecosystem development strategy. These features position WXT as a multifunctional token that appeals to both active traders and long-term participants within the ecosystem.

Exchange Tokens and Their Growing Potential

This bull market has further cemented the role of platform tokens as integral components of exchange ecosystems. Platform tokens have shown their ability to enhance user engagement by offering features such as fee adjustments and access to platform-specific benefits. As WXT gains momentum, how will it evolve within the ecosystem and shape its role in the platform token landscape? While its recent performance is promising, only time will tell if WXT can achieve the same level of success as its peers.

About WEEX

Founded in 2018, WEEX Exchange swiftly rose to prominence as a key global player in the cryptocurrency sphere. Boasting a diverse selection of over 1,000 trading pairs and spearheading a zero trading fee initiative for new token introductions, WEEX Exchange has earned widespread recognition throughout the industry. Introducing “WEEX WE-Launch,” a portal to exciting opportunities that empower users to acquire WXT tokens and engage in exclusive token giveaways, signaling a new chapter of participation and empowerment. With an active user base exceeding 5 million, WEEX Exchange has solidified its standing as a top 5 platform on CoinMarketCap, underscoring its unwavering commitment to excellence.

For more information:

Photo – https://megastockalert.com/wp-content/uploads/2025/01/All_Time_High_Price_Change.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/wxt-surged-101-in-24-hours-and-the-price-exceeded-0-339-why-can-wxt-go-to-the-moon-302349299.html

View original content:https://www.prnewswire.co.uk/news-releases/wxt-surged-101-in-24-hours-and-the-price-exceeded-0-339-why-can-wxt-go-to-the-moon-302349299.html

Featured Image: Pexels @ olya kobruseva