This post was originally published on this site

Cryptocurrencies experienced a significant downturn, with bitcoin (BTC) plummeting to below $66,000 and altcoins witnessing declines ranging from 10% to 15% on what proved to be a challenging day for risk assets.

Ryze Labs, in a report, warned investors to brace for continued market weakness beyond the current decline, attributing it partly to the ongoing tax season.

During the U.S. trading session, digital assets succumbed to risk-off sentiment prevalent in traditional markets, exacerbated by heightened geopolitical tensions. Bitcoin, which had flirted with the $71,000 mark earlier in the day, saw a rapid descent to $66,000 before rebounding slightly to $66,700, marking a more than 5% decrease over 24 hours.

Ether (ETH), the second-largest cryptocurrency by market cap, mirrored bitcoin’s decline, plunging as much as 12% to $3,100 before a modest recovery trimmed the losses to 8%.

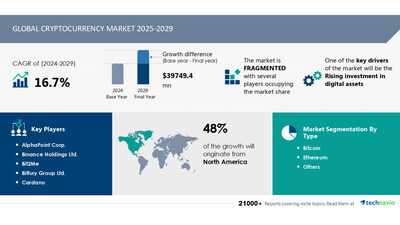

The broader crypto market was hit harder, with the CoinDesk 20 Index (CD20) witnessing a nearly 10% drop. Altcoins like Cardano’s ADA, Avalanche’s AVAX, bitcoin cash (BCH), filecoin (FIL), and aptos (APT) suffered losses ranging from 15% to 20%.

The market turbulence triggered the largest leverage washout in a month, with approximately $850 million of leveraged derivatives trading positions across all digital assets liquidated, according to CoinGlass data. Long positions, amounting to $770 million, were particularly affected, as investors betting on rising prices found themselves caught off guard by the sudden downturn.

The dip in crypto prices coincided with a decline in stock markets amid escalating geopolitical tensions in the Middle East. U.S. authorities’ warnings of a potential significant attack by Iran on Israel contributed to a risk-off atmosphere, prompting investors to seek refuge in traditional safe-haven assets such as Treasury bonds and the U.S. dollar index (DXY).

Meanwhile, digital asset investment firm Ryze Labs cautioned of short-term market softness due to the upcoming tax season but maintained a positive long-term outlook. It anticipates relief for the asset class as policymakers may adjust monetary policy to facilitate U.S. government debt rollovers.

Featured Image: Freepik