MJAlert

Written by ProfitSeeker on . Posted in MedicalMJ, Penny Stocks, Stocks.

(CSE: CRFT) (OTC: CRFTF)

Craft Cannabis Collective Pasha Brands Expects First Harvest

Around 100 kilograms of small-producer product will be the company's first major test in retail

Canada’s largest organization of craft cannabis producers, Pasha Brands Ltd. (CSE: CRFT) (OTC: CRFTF), is expecting its first harvest just in time for the holidays.

But Canadian consumers won’t quite be able to stuff their loved-ones’ stockings with the new offering, as the company expects the product to hit shelves in early 2020 — approximately 100 kilograms if it, according to spokesperson Jamie Shaw.

The move will be the company’s first major test in retail. So far, other sellers of high-end craft products have shown to be robust players in the market, but a mounting glut of unfinished inventory and poor quarterly financial reports are giving investors cause for concern across the industry.

The grinchy green buds will come from three separate micro-cultivators: Canandia, Hearst and North 40. Each of the growers hails from a different province: British Colombia, Ontario and Saskatchewan, respectively.

Pasha Brands has a distribution agreement with Great North Distributors Inc., which it signed this July. Great North also has exclusive distribution agreements with Aphria Inc. (NYSE: APHA) and American cannabis beverage producer The Tinley Beverage Company (CSE: TNY) (OTC: TNYBF).

The distributor is part of Southern Glazer’s Wine & Spirits, a private company and North America’s biggest wine and spirits distributor doing US$17.5 billion in sales.

Bringing small producers to the big stage

Part of Pasha Brands’s mission statement is a commitment to bringing small farmers and prohibition-era growers to market.

“While the large-scale licensed producers continuing to experience pressure in the market, Pasha’s approach looks to solve both industry and consumer issues by bringing small-scale growers into the legal marketplace,” the company said in a press release.

Pasha says it signed supply agreements with over 100 micro-cultivator applicants, including the first five micro-cultivators licensed by Health Canada.

“To me, craft cannabis is about quality over quantity, and a more individualistic approach to cultivation,” Shaw said. “It’s the whole reason our model exists, allowing the grower to stay autonomous and avoiding large plant-to-grower ratios. This allows them to function independently and ensures a move away from big-box, cookie-cutter production.”

North 40 founder Gord Nichol said in the release that having Pasha’s support has allowed him to focus on the cultivation side of his business.

“The market is ready for hand-crafted cannabis products and Pasha’s experience is a vital resource in helping us deliver the goods,” he said.

KEEP ME INFORMED ON CRFTF UPDATES

About Pasha Brands (CRFTF)

Pasha Brands is a vertically integrated prohibition-era brand house that is firmly rooted in BC’s craft cannabis industry, which boasts a reputation as the worlds best.

With a proven history in cannabis cultivation, genetic research and development, product processing, and retail, Pasha is uniquely positioned in the new legal cannabis market through its network of hundreds of craft cannabis professionals under the company umbrella.

Health Canada has created new opportunities for small – scale producers, known as Micro Cultivators (MC) to enter the market.

Micro – cultivators are not able to sell directly to the public for recreational use and must sell to Licensed Producers (LP) or Standard Processors (SP).

Pasha estimates that EACH of the licensed MCs will produce approximately 500 kg of flower per year at $3,000 – $6,000 per kilogram, resulting in annual revenues of $2,500,000 per mc.

KEEP ME INFORMED ON CRFTF UPDATES

Pasha is committed

to helping these small – scale growers become licensed as MCs and move from the grey to the legal market while solving supply issues and quality issues within the current marketplace.

Pasha offers its team of craft growers access to a state-of-the-art mobile lab that features $1.2 million dollars worth of high – performance lab equipment.

Small scale growers need to get licensed to legally sell their cannabis. Pasha Brands offers the solution.

PhD. scientists and quality experts trained on current best practices offer growers custom reference materials for research and analytical testing purposes

The lab and its experts can produce on- the- spot and incredibly accurate results along with explanations.

Pasha offers this invaluable resource for craft growers so they can be confident about the various levels of cannabinoids in their products.

This lab reduces the risks associated with mislabeling of substances and contamination as well as increases safety.

the retail market

Many wonderful craft cannabis brands make up the Pasha Family, and there is a unique opportunity to sell them all under a collective retail storefront.

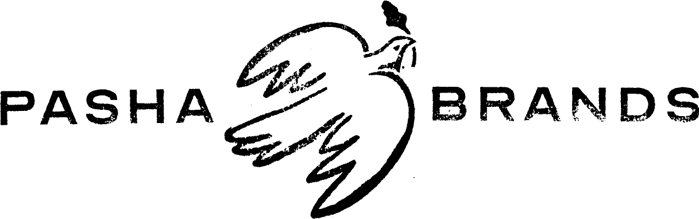

With the British Columbia government deciding to allow privately owned retail stores to operate in the province, Pasha is in the process of assembling licensed retail storefronts in B.C.’s key markets such as Vancouver, Victoria, Kelowna, Vernon and Kamloops.

Stores will be designed with a west coast vibe and influenced by the neighborhood in which operated in. All staff will be highly trained by experts with years of experience in all facets of the cannabis industry and armed with the most up – to – date POS cannabis software.

KEEP ME INFORMED ON CRFTF UPDATES

recent developments

Disclaimer

We have received twenty thousand dollars for the awareness of CRFTF

Any type of reproduction, copying or distribution of the material in this email is prohibited without a written consent from the site owner.

Disclaimer- By reading our newsletter you agree to the terms of our disclaimer, which are subject to change at any time. Owners and affiliates are not registered or licensed in any jurisdiction whatsoever to provide financial advice or anything of an advisory nature. Always do your own research and/or consult with an investment professional before investing. Low priced stocks are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold us, our editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters, website, twitter, Facebook and chat. We do not advise any reader take any specific action. Our website, newsletter, twitter, Facebook and chat are for informational and educational purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter, twitter, Facebook and on our website may be based on EOD or intraday data. We may be c.ompensated for the production, release and awareness of this newsletter. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. Our emails may contain Forward Looking Statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters, twitter, Facebook our website and chat is believed to be accurate and correct, but has not been independently verified. The information in our disclaimers is subject to change at any time without notice.

We are not held liable or responsible for the information in press releases issued by the companies discussed in these email’s. Please do your own due diligence.